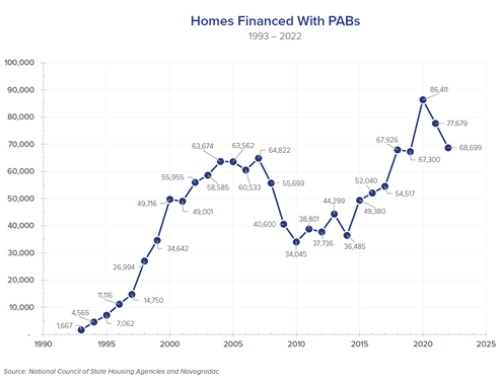

Developers face increasing competition for bonds in several states.

In a growing number of states, the demand for critical private-activity bonds (PABs) is outpacing supply. This is quickly becoming a serious issue for developers who rely on these tax-exempt bonds to help finance the construction or preservation of affordable housing. Nationally, the issuance of multifamily bonds has more than doubled from about $7 billion in 2015 to over $14 billion in 2018, creating a more competitive arena, according to the Council of Development Finance Agencies.