Affordable housing developers are starting the new year on a hopeful note after Federal Reserve officials left interest rates unchanged at the end of 2023 while signaling that cuts may be on the horizon. That would bring some needed relief to developers who were hit with rising operating and development costs last year, including higher interest rates that made it difficult for many new deals to pencil out. “We are expecting a moderately better year in 2024 than what we saw in 2023,” says Paul Weissman, head of affordable housing.

The Federal Reserve held the target federal funds rate at 5.25% to 5.5% in December. However, projections at that time are for rates to settle around 4.6% by the end of this year. “If interest rates hold steady from recent drops or go even lower, developers will be better positioned to structure more deals and bring more units to the market,” says Daron Tubian, head of affordable housing investments at Barings.

But, even if interest rates hold firm or even decline in 2024, new construction projects will still face big hurdles. “Construction costs remain high, although we have seen some moderation,” Weissman says.“Interest rates and LIHTC pricing are such that gaps will continue to exist on new construction transactions. A lot of the American Rescue Plan funding has been spent, and, despite legislation across the country to increase other sources of funding, we believe that new construction will continue to be challenging.”

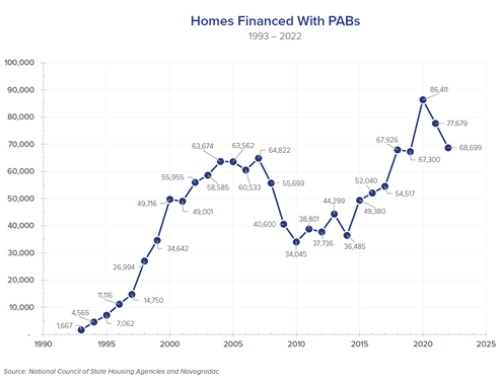

Last year, developers had already put considerable pre-construction dollars into their deals, and there was soft money available. These transactions where developers may have had to leave money in or had large deferred fees still got done to prevent the loss of the money already in the deals. “Many of those developers have been more cautious about spending money given the challenges they faced over the last two years,” Weissman says. “That said, we’re expecting to see a higher ratio of rehab deals over the course of 2024 due to the likely availability of more bond volume cap.