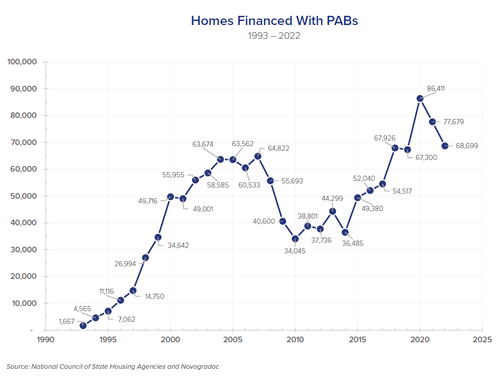

The increased use of tax-exempt, private activity bond (PAB) financing for affordable multifamily housing shows no signs of slowing, despite high interest rates and increased construction costs.

“I can say the trend line [for 2024] is at minimum flat, if not slightly increased,” said Kent Neumann, a founding member of Tiber Hudson LLC, a national law firm that specializes in bond-financed affordable housing.

The national PAB cap used for affordable rental housing more than tripled over six years, going from $6.6 billion in 2015 (possibly an undercount, due to states not reporting data) to surpass $20 billion for the first time in 2021, based on data examined by Novogradac. Based on Novogradac’s examination of PAB data and Neumann’s work at Tiber Hudson, the market is holding its own or growing, thanks in part to efforts by states to emphasize and incentivize PABs as a tool for affordable multifamily housing.